5 Alternatives to Sourcing from China

What country comes to mind when you hear the term “manufacturing hub”? China? Vietnam? Indonesia? There’s a long list of potential countries from which manufacturers and buyers can choose to source products. The real question is which country is best – or, more to the point, which country is best for you?

In an earlier bulletin, we answered the compelling question: Is sourcing in China still competitive? What we found was that China does, despite rising wages, still hold some major competitive advantages over its smaller manufacturing counterparts.

But the benefits you receive when sourcing from China may not be as great as those you could realize elsewhere. There are a host of up-and-coming players in Southeast Asia that are competing with China as hot spots for manufacturing – and labor costs are not the only determining factor.In this bulletin, you’ll learn about five of the region’s growing manufacturing hubs and the different opportunities and challenges presented by each.

Sourcing from Vietnam

Vietnam’s top manufacturing sectors include food processing, tobacco, textiles, chemicals and electrical goods. The country continues to experience rapid growth as its government’s repeated Five-Year Plans have brought Vietnam into closer integration with the global marketplace.

Advantages

Recent foreign-friendly reforms now allow foreigners to own property as well as majority holdings in Vietnamese companies. This has made Vietnam an attractive location for foreign investment and those manufacturers wishing to open their own factories. Easier access to credit has also added to the notion that Vietnam is “becoming the ‘new China’ with foreign manufacturers”.

Vietnam’s upholding of copyrights and prevention of counterfeit goods has made it a strong alternative to sourcing from China. It updated its intellectual property laws to comply with the internationally-recognized Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) in 2006.

The country’s geography is another advantage. Vietnam generally suffers fewer natural disasters than its neighboring manufacturing nations. Furthermore, manufacturers that wish to move production from China will benefit from easier integration with their existing supply chains, due to the close proximity of the two countries.

Disadvantages

A possible risk to manufacturing in Vietnam has been the propensity for worker strikes. Anti-Chinese sentiment from territorial disputes led more than 15 foreign-owned factories to be shut down following violent protests in May 2014. Another strike occurred at a major footwear factory last month, over social insurance benefits. Worker unrest has led some to question the viability of Vietnam for sourcing.

To learn more about sourcing from Vietnam, see 3 Key Factors for Sourcing in Vietnam.

Sourcing from Thailand

Thailand’s major manufacturing sectors include cars, computer components, chemicals and food processing. The country experienced rapid growth between 1985 and 1996 – more than an average of 12 percent annually. Today Thailand is the world’s second largest producer of hard disk drives (HDDs).

Advantages

Thailand’s government is planning a major infrastructure upgrade to the tune of $100 billion over a 7-year period. The plan will include new rail lines that will replace trucking and link up Thailand with China. Railway expansion and upgrades will potentially benefit manufacturers logistically.

Disadvantages

A possible threat to manufacturing in Thailand is the country’s political instability. Over the last decade, there have been two military-led coups following frequent protests. Rapid shifts in political power and social order could be cause for concern when sourcing from Thailand.

Thailand’s geography poses a second threat. Heavy rains during the country’s monsoon season have led to significant flooding. Major flooding in 2011 led to at least $45 billion in economic damages.

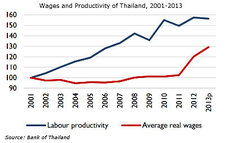

Lastly, the country’s relatively high minimum wage makes sourcing from Thailand a less attractive option for some. Minimum wage is set at roughly $274 per month compared to Vietnam’s approximate average of $191 per month. Also decline in surplus labor is expected to push wages in Thailand even higher.

Sourcing from Malaysia

Malaysia is a major exporter of consumer electronics, electrical components, and cars. According to a report from the Malaysian Automotive Association, the country’s automotive facilities produced and assembled nearly 600,000 vehicles in 2014. Malaysia’s economy is the third-largest in Southeast Asia, despite having a population much smaller than that of Thailand or Indonesia.

Advantages

Exporters in Malaysia benefit from no value added tax, as compared to a tax of about 17 percent normally levied on exports from China.

Some manufacturers may benefit from Malaysia’s ease of entry. According to a 2014 report by the World Bank Group, Malaysia is ranks 6th in the world in ease of doing business, and scored 1st in easy credit and 5th in cross-border trade.

Malaysia’s geography offers significant advantages in terms of shipping goods, as it is located on the Strait of Malacca, an important shipping lane. The country is home to Port Klang and the Port of Tanjung Pelepas, the 2nd and 3rd busiest ports in Southeast Asia, respectively.

Disadvantages

A competitive hindrance to consider when sourcing from Malaysia is the country’s labor cost. An average manufacturing wage of $800 per month in February 2015 makes Malaysia the most costly in terms of labor among countries in Southeast Asia.

Sourcing from Indonesia

As the largest economy in Southeast Asia, Indonesia also has the world’s 4th largest population with 250 million inhabitants. Its major exports include palm oil and coal, and the country has seen a fast rise in consumer purchasing power in recent years.

Advantages

A second advantage offered by Indonesia may lie in the government’s $436-billion-dollar plan surrounding upgrading infrastructure. The plan includes improvement of 24 of the nation’s ports.

Lastly, Indonesia offers more politically stability over Thailand and Vietnam, which serves to reduce risk for manufactures.

Disadvantages

Indonesia’s geography presents a risk to both production and logistics. The country is located in Southeast Asia’s “Ring of Fire” region, and home to 130 active volcanoes. A volcanic eruption in the province of East Java, for example, caused the closure of 7 airports and the evacuation of 76,000 people in 5 cities.

Sourcing from the Philippines

The Philippines are now Asia’s second-fastest growing economy, sporting growth of 6.1 percent in 2014. Major manufacturing sectors include semiconductors, electronics, transport equipment and garments.

Advantages

English is one of two official languages of the Philippines, making the country much more international in terms of doing business. This also means that foreigners manufacturing in the Philippines are free from many of the barriers of communication which commonly plague those that source from China.

The government of the Philippines hopes to spur growth in the country’s automotive manufacturing sector and will offer tax breaks to major manufacturers that meet minimum volume requirements. Automakers could find opportunities to lower their bottom line with these economic incentives.

Disadvantages

Partly due to the country’s geographic location, the Philippines suffers major setbacks where infrastructure and logistics are concerned. The country is made up of some 7,100 islands. And of the 200,000 kilometers of roads, only about 25 percent are paved. To make matters worse, the International Maritime Bureau reports a piracy risk in the offshore waters in the South China Sea, where numerous commercial vessels have been attacked and hijacked.

Conclusion

Southeast Asia offers a number of alternative destinations for your base of manufacturing. Vietnam, Thailand, Malaysia, Indonesia and the Philippines are just a few of the trending countries in the region that have offered manufacturers competitive advantages over sourcing from China.

Ultimately, your decision to shift manufacturing to Southeast Asia from elsewhere will depend on your unique sourcing needs. Are you a buyer that’s especially sensitive to factors such as the cost of labor or value-added tax? Or are you hoping to set up your own factory and worry about ease of entry? Will the raw materials used for production be sourced from China? And are you willing to invest in waiting on the arrival of local reforms and improvements to infrastructure? These are all questions you may want to ask yourself before making a of sourcing change.

For many buyers, China remains the top choice for manufacturing. But as all experienced traders know quite well, your sourcing strategy will not be a one-size-fits-all solution, and it will likely change over time. So make sure to do your homework!

About John Niggl & InTouch Manufacturing Services

John Niggl is a Client Manager of InTouch Manufacturing Services, which provides solutions to quality and overseas manufacturing issues through product inspection and related quality control services. John is also Editor of the QC-related blog, Quality Wars.