China’s Currency Devaluation and Your Manufacturing

It should come as no surprise that China’s manufacturing sector has been, and still is, the driving sector of growth in the country. China has become the workshop of the world over the past 30 years on the back of a dynamic and growing manufacturing sector. Does the currency devaluation signal a weakening of China’s economy and thus a signal to stay away? Or, on the contrary, does it signal an aggressive move by the Chinese government to make its manufacturing sector more competitive?

How Does Currency Devaluation Work?

The mechanism behind currency devaluation is fairly straight forward and is really linked to the quantity theory of money. The theory states that a currency will depreciate inversely with the quantity of the currency in circulation. That is, the more of a currency there is chasing the same number of good and services, the less that currency will be worth. Thus, to devalue a currency a Central Bank aims to put more of the currency in circulation. This can be done in an assortment of ways:- The central bank can print money and buy goods

- The central bank can buy up bonds; or

- The central bank can lower reserve requirements for banks (for more info see How do central banks inject money into the economy?)

In the preceding graph we see the sudden devaluation. The Yuan traded consistently around 6.15 Yuan per U.S. Dollar for several months before dropping to 6.22, seemingly overnight. The graph below shows that, interestingly, other global currencies have also been devalued compared to the Yuan over the past year and a half.

Why Do Countries Devalue Their Currency?

What is the goal of currency devaluation? The answer to this question depends on the specific circumstances of the country considered. However, with that said, there is usually one fundamental goal in mind: the goal of currency devaluation is to stimulate exports. While this is usually the case, it is important to note that in some countries a currency devaluation is an unintended side effect of governments simply spending too much money. Or, stated differently, currency devaluation is a side effect of inflation (see historic examples of hyperinflation).The mechanism by which devaluation stimulates exports is fairly straightforward and depends thoroughly on the degree of price flexibility, or lack thereof, in various exporting sectors. If prices are not fully flexible, or are sticky (i.e. inelastic), then prices won’t adjust immediately to changes in exchange rates. The consequence is fairly simple: if prices on exports don’t respond quickly to changes in exchange rates, then a devaluation of a currency makes exports cheaper. In a sense, currency devaluation is like having a country-wide sale — all exports are suddenly cheaper to purchase. The following statement sums up this concept: “Devaluation makes an economy instantly more competitive in the international markets as it boosts the competitiveness of the local labor force” (see how devaluation lowers wages). Just as export prices are sticky, so are wages. So, in effect, currency devaluation is also a wage cut across the entire country.

Countries often devalue their currency after a long period of running a current account deficit. A deficit occurs during a period where they are importing more goods and services than they export. Thus, the goal is generally to balance the current account.

This is not the case with China, though. China has run a current account surplus for a long time. So one is very tempted to ask, why stimulate an export sector when you are already exporting more than you import? The answer is that the Chinese government is hypersensitive to slowdowns in the economic growth rate of China. The Chinese government wants to show it is aggressively committed to maintaining China’s position as a global manufacturing and export leader.

Does Currency Devaluation Solve the Long-Term Problem?

The problem with currency devaluation is that it doesn’t solve any long-term problems. The reason China’s growth has slowed is largely due to increases in wages among the Chinese labor force. This is an inevitable process that will happen as China, or any country, grows and develops a more diverse and capital-abundant economy along with a more skilled labor force.In recent years, as a result of increasing Chinese labor costs, many companies and investors have moved away from China to other countries in Asia and Africa that offer cheaper wages (see 5 Alternatives to Sourcing from China). The following quote from the China Business Review sums up much of the issue:

Executives across China have been quick to mention rapidly increasing labor costs in recent years as one of their top concerns for their China operations. China’s labor costs in the urban manufacturing sector reached ¥31,000 ($4,579) per employee per year in 2010, more than doubling from just ¥12,700 ($1,534) in 2003. This represents a compound growth rate of 13.8 percent in renminbi (RMB), or 17 percent in dollars after taking RMB appreciation into account. China’s costs are growing at a faster rate than many other countries with low overall manufacturing costs, such as Vietnam, India, and Mexico.

The currency devaluation will temporarily offset these increases in wages, but it is not a solution to the long-term trend as prices and wages will, eventually, adjust to the currency devaluation. China’s manufacturing sector seems destined to lose some of its competitive edge as wages rise over time (see Is Sourcing in China Still Competitive?). Furthermore, it is in China’s best interest to let wages rise in the long run. But the recent currency devaluation clearly indicates that the Chinese government feels the process of rising wages can be delayed.

It should also be noted that devaluing a currency can have many other consequences that come with long-term effects. The most notable is that currency devaluation can cause a currency war. Other countries might try to counter China’s devaluation by devaluing their own currency. The result can be a spiral of devaluation that threatens to ultimately limit and shrink global trade. The illustration above depicts a possible war between the Yuan, Dollar and Euro as each country, or block, devalues its currency to promote their exports.

What Are the Short-Term Consequences of Currency Devaluation?

The short-term consequences of currency devaluation are fairly straightforward. Cheaper Chinese currency benefits Chinese exporters, those who import from China and consumers as a whole. As mentioned, the devaluation is almost like a country-wide sale, which will stimulate exports. This currency devaluation also signals lower prices on Chinese exports, and so it represents a good time to buy Chinese goods.Furthermore, the effects of China’s currency devaluation are far-reaching as it affects production costs in various ways, depending on the specific product or industry. Currency devaluation not only stimulates lower wages, it also lowers the costs of all sorts of inputs to production so long as those inputs are paid for in Yuan. Any input that is not fully flexible to changes in exchange rates and purchased within China, including land, rent and energy, will be cheaper. Chinese manufacturers accept payments for exports in foreign currency and pay for many of their inputs in Yuan. Thus, depending on the specific product type, it may be a great time to buy Chinese goods, as savings attained from cheaper production inputs could be passed on in the form of lower purchase prices.

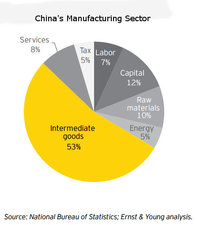

It should be noted that not all inputs are paid for in Yuan. Some inputs, such as capital and machines, will actually increase in price. The figure below shows the overall input costs for the manufacturing sector in china as a whole. Labor is a relatively insignificant input cost (only 7 percent). So differences in cost of manufactured goods depend on the specific product being produced and exported. If a particular manufacturer relies heavily on intermediate goods — goods that are semi-finished — sourced from other countries, then the cost of production will increase. The bottom line is the devaluation will have far-reaching effects, and overall costs of production will depend on the specific product or industry.

Conclusion: The Big Picture

In conclusion, the big picture is mixed. The underlying cause of the currency devaluation was a reaction to signs that growth of the Chinese economy is slowing. This fundamental cause of the currency devaluation is not a good sign for China and could be taken as a small red flag for those interested in doing business there. However, it should be emphasized that efforts to devalue the Chinese currency to make exports more attractive doesn’t mean that China is suddenly disappearing as an important player on the global manufacturing stage.

The currency devaluation has important short-term and long-term aspects that should be appealing to those interested in investing and importing from China. The positive story is twofold:

-

In the short term there will be relative bargains on exports as prices adjust to the currency devaluation.

-

Currency devaluation signals how serious the Chinese government is about maintaining high growth rates and further expansion of China’s export capacity.

This last message is a very important take away. Over the past 30 years China has been a growth miracle as it has become the leading country in the world with regards to manufacturing. This is a position China has fought hard to attain, and has demonstrated a willingness to maintain. Any investor should be cautious of the Chinese economic slowdown. However, in the same breath, investors should be encouraged by China’s commitment to stay competitive in the production and export of manufactured goods.

About Scott Auriat

Scott Auriat comes from Edmonton, Alberta Canada and is passionate about the field of economics. He is currently working on a PhD from one of Canada’s top universities and plans to work as an applied economist. His areas of expertise are economic growth and international trade. Scott has lived in Shanghai and Ningbo.